Financial Cybersecurity Training for International Students

Moving to Canada for your studies? You're not just learning about technology — you're stepping into one of the world's most dynamic cybersecurity markets. Financial institutions here need people who understand both the technical side and the real business risks behind every decision.

Our program helps international students build practical skills in financial cybersecurity that employers actually need. You'll learn how banks protect customer data, how payment systems stay secure, and what happens when things go wrong. Not theories from textbooks. Real scenarios based on actual incidents.

Study permits come with work restrictions. Most international students can work up to 20 hours per week during semesters and full-time during breaks. Our flexible schedule fits those limits while giving you time to balance coursework, part-time work, and your own life outside classes.

What You'll Actually Learn

Financial cybersecurity isn't about memorizing encryption algorithms. It's about understanding how systems fail and what attackers look for. Canadian banks lose millions each year to fraud and breaches. Someone needs to prevent that.

Core Technical Skills

We focus on practical tools and methods used by security teams at major financial institutions. Network monitoring. Threat detection. Incident response procedures. You'll work with the same software and frameworks that professionals use every day.

- Payment gateway security and transaction monitoring systems

- Identity verification processes and access control mechanisms

- Fraud detection patterns in digital banking environments

- Security compliance standards specific to Canadian financial regulations

Understanding Business Context

Technical skills alone won't get you hired. Banks need people who understand why security matters to the business. A data breach doesn't just affect servers — it destroys customer trust and triggers regulatory penalties. You'll learn how to communicate security risks to people who don't speak tech.

Our instructors work in the industry. They share stories about real incidents, not just case studies from five years ago. You'll see how decisions get made under pressure and what happens when companies cut corners on security.

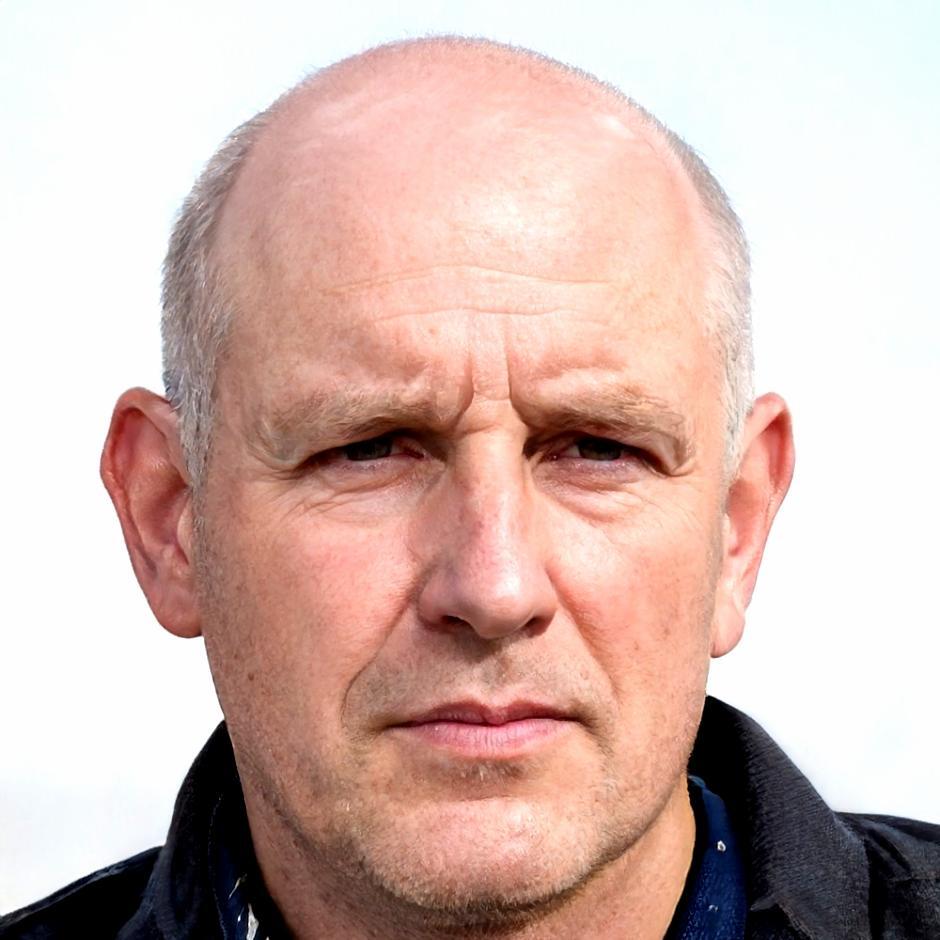

Elliot Rasmussen

From Sweden, now Security Analyst

I came here knowing basic programming but nothing about financial systems. The program showed me how banks actually operate and where vulnerabilities exist. Now I work with a team protecting payment infrastructure.

Kenji Nakamura

From Japan, Compliance Specialist

The best part was learning from people who've dealt with actual security incidents. They didn't sugarcoat anything. You learn what works in theory versus what works when your systems are under attack.

Dmitri Volkov

From Russia, Risk Assessment Analyst

Coming from a different regulatory environment, I needed to understand Canadian financial laws and standards. The program covered compliance requirements in detail, which helped me transition into the local market faster than expected.